Do Speeding Tickets Affect Insurance?

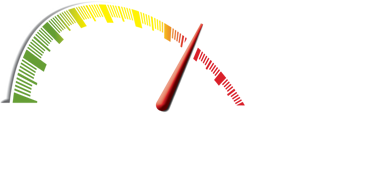

Very few drivers understand that accumulating speeding tickets on their driving record can cause catastrophic increases in their insurance premiums. Read on to find out how much that really is…

How Does a Speeding Ticket Affect Insurance?

The amount of the fine on your speeding ticket has no impact on your insurance. Demerit points, contrary to popular belief, also have no impact on your insurance premiums. The most critical thing to controlling insurance premiums is managing your driving record (often plea bargaining) so the violation that ends up on your record has little to no effect on your rates... so something that is definitely NOT a speeding ticket.

If you’ve been pulled over for speeding, it doesn’t matter whether it was for 5 km over of 35 km over… all pullover speeding tickets are hazardous violations and will most definitely affect your insurance rates. If however you get a speeding ticket in the mail (a photo radar ticket) there is no insurance impact or demerits, and the only thing you need to worry about is the fine payment.

How Much Does a Speeding Ticket Increase Your Insurance in Alberta?

A licence suspension caused by a major speeding violation can result in an insurance increase equivalent to an impaired driving conviction! What is even more shocking is you can get the same insurance increase results from just a few minor speeding tickets over a 3 year span! Your insurance rates can realistically quadruple (yes, really!)

Remember, a speeding ticket insurance increase is in effect for a minimum of 3 years. Do the math and you'll understand why you hire The Pointman to stop this from happening!